The much-anticipated post-Covid-19 party is over before it could even begin. The dance floor is likely to remain empty in the foreseeable future and the music that started fading out long before the pandemic struck the Indian shores has now stopped playing. Instead, one can feel the explosion of the Russian bombs and missiles raining on Ukraine shaking the ground below the Indian economy. And all the while trouble was brewing like a witch’s cocktail since November last year when Vladimir Putin started amassing troops and armour on Ukraine’s borders, Prime Minister Narendra Modi’s government was busy eyeballing the election landscape in UP and other states.

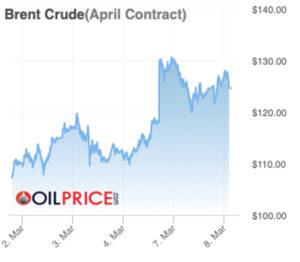

So, now we are in a situation as Putin’s war plans come unhinged in Ukraine one day at a time has pushed the Brent crude index above $120, the rupee has hit a lifetime low, inflation based on the Wholesale Price Index (WPI) rocketing to 12.96%, unemployment rate hovering at 7.8% and the third quarter GDP for 2021-22 recording slower growth at 5.4% compared to 8.4% of the previous quarter even before accounting for the third wave lockdown in January lead to the conclusion that the rough ride is just about starting. So, tighten your seatbelt and brace for impact.

With sweeping international sanctions against Russia kicking in, JP Morgan warned on March 3 that if the supply disruptions continue, international oil prices might skyrocket to a never-seen-before figure of $185 per barrel by the year-end. According to the report, 66% of Russian crude is struggling to find buyers due to the sanctions that have been imposed following the invasion. With Russia kicked out of the SWIFT system for conducting cross-border transactions, countries like India, which have not taken any position on the sanctions announced by the US and its European allies, will be hobbled to import Russian crude. The only option for India is to set up a rupee trade account, but such a move is most likely to invite severe international censure.

India imports approximately 85% of crude to meet its domestic demand. From April 2021 to November 2021, when the price of international crude ranged from $61 to $80, the retail price of petrol was increased by ₹19 and diesel prices shot up by ₹18 in Delhi. In Mumbai, this escalation was much steeper. The upward revision of fuel prices stopped on November 4 solely because elections were due in five states in February 2022, including UP, which is very critical in the BJP’s scheme of things. By the government’s own admission in the parliament, it had mopped up more than ₹8 lakh crore in the past three fiscals in taxes (mainly excise duty) from the fuel basket of which ₹3.71 lakh crore was extorted in 2021 alone, translating to an 88% increase since 2018.

Now, with the international oil prices on fire once again, and OPEC being noncommittal about increasing production to bring down the price, the Modi-led government has no option but to increase the fuel prices significantly. According to various reports, fuel prices need to increase by ₹15 to ₹22 for the oil marketing companies to break even. If the international oil prices continue to maintain the current upward trend, which most likely will until OPEC output increases, retail fuel prices in India will keep rising for better part of the year or until the next state elections. And this will have a devastating cascading effect.

It’s estimated that the international crude price rise and sharp depreciation of the rupee will create a hole of more than ₹1 lakh crore in the government’s coffers. So, how will the Modi government fill this hole? Yes, you guessed it right—by further increasing taxes on fuel, which includes petrol, diesel, LPG, CNG and PNG. After all, India’s fuel basket is the golden goose that lays the tax egg at the cost of the consumers.

Food inflation based on WPI was already running amok 9.6% even before Russia’s war and inflation based on the Consumer Price Index (CPI) rising to 6.01% in January 2022 compared to 5.66% a month earlier is well past the upper limit of Reserve Bank of India’s (RBI) revised target of 5.7%, that itself is higher than the earlier ceiling of 5.1%. Shorn of geekery, it means with rising fuel prices, which is inevitable, the price of food and other household items are going to see a serious spike in the coming months. In this situation, the RBI cannot resort to its go-to tool of increasing interest rates to control inflation because it will trigger a credit squeeze, which will adversely impact industrial activity that already witnessed contraction in Q3 of the current fiscal. In short, the Indian economy is trapped between a rock and a hard place, with little wriggle room available.

Other macro-economic indicators also point towards a bleak outlook, at least in the short term.

Sector-wise GVA for Q3 2022 (in percentage)

| Sectors | Q1:2021 | Q2:2021 | Q3:2021 | Q1:2022 | Q2:2022 | Q3:2022 |

| Agriculture | 3.0 | 3.2 | 4.1 | 3.5 | 4.5 | 2.6 |

| Mining | -17.8 | -7.9 | -5.3 | 17.6 | 14.2 | 8.8 |

| Manufacturing | -31.5 | 5.2 | 8.4 | 49.0 | 5.5 | 0.2 |

| Construction | -49.4 | -6.6 | 6.6 | 71.4 | 7.5 | -2.8 |

| Trade & Hotels | -49.9 | -18.8 | -10.1 | 34.3 | 8.2 | 6.1 |

| Finance, Real Estate, etc | -1.1 | -5.2 | 10.3 | 2.3 | 7.8 | 4.6 |

Source: National Statistical Office

If the October-December quarter GDP is considered, it’s clear that the uptick in the economy post the lethal second wave of the pandemic was tapering off, which forced the government to revise the growth estimate for 2021-22 from 9.2% to 8.9%. But the fine print is that even this growth will come on the back of the previous year’s GDP contraction of 6.6, which means the effective growth rate will be a mere 2.3%. Some of the key growth drivers showed significant signs of slowing down in the third quarter. For example, the manufacturing sector crawled at a mere 0.2% and the construction sector, which provides large-scale employment to skilled, semi-skilled and unskilled workers, registered a contraction of -2.8%, while the agriculture sector registered a mere 2.6% growth, which was lower than 4.5% of the previous quarter. These three sectors account for maximum jobs and with their slowing down pry open the serious structural flaws in the Indian economy, which the Modi government has not attended to with any serious intent.

Little wonder that the RBI’s Consumer Confidence Index for January 2022 remained negative at 63.7, reflecting a marginal improvement of 1.4 basis points compared to 62.3 in November as 67.5% of the respondents felt that the economic condition worsened. On the employment front, 66.4% of the respondents felt that the situation has worsened compared to November 2021. This data point bears a strong correlation with CMIE’s unemployment data. On price and income indicators, the sentiments of the respondents remained in the red zone.

The writing on the wall is crystal clear that if the government doesn’t find a way to steer the Indian economy through the minefield, we might be dealing with a serious crisis and no amount of headline management will serve any good.