Cryptocurrency or Cryptos is the latest flavour of the day. After stocks and mutual funds, cryptocurrency is pretty high in the pecking order. Those with yawning risk appetites, and in a hurry, are choosing them for investment. Also, those who repose faith in tomorrow and blockchain technology. Little wonder, then, the latest topic of discussion is whether or not India should allow cryptocurrency. But this decision may be a bit too late as already around ₹7.5 lakh crore ($10 billion) has been invested in various currencies. The figure is obviously a guesstimate in the absence of information as such currency operations are protective of identity – their USP is anonymity. So, what precisely are we talking about?

The advent of cryptocurrency occurred after the financial crisis of 2008 when people lost faith in central banks, when the Federal Bank and the European Central Bank (ECB) went all out to bail out institutions as well as provide loads of liquidity to ensure economies were revived. This raised questions about the prudence being exercised by banks, which in turn led people to explore the creation of alternative currencies.

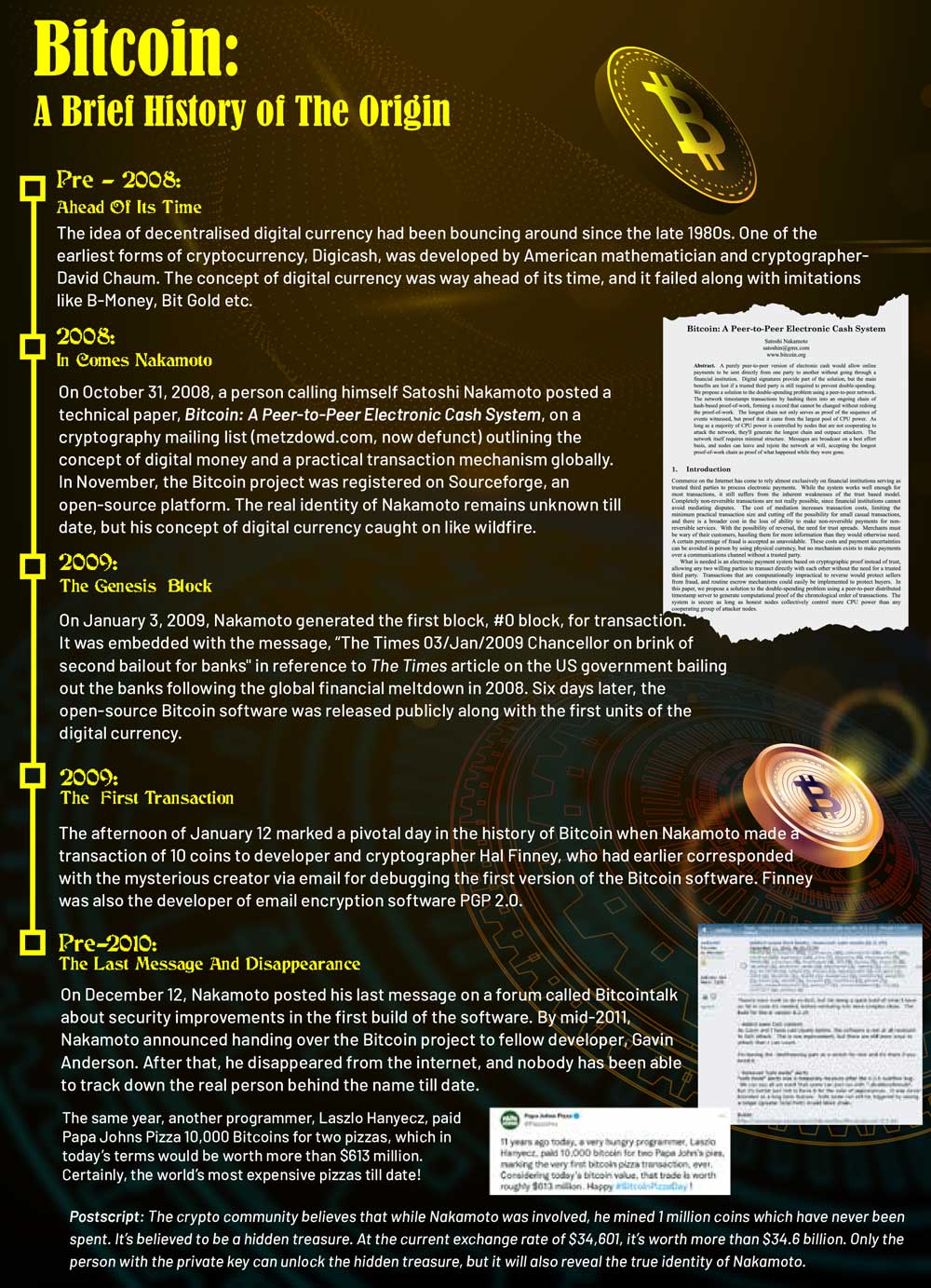

The first was Bitcoin, which came in 2009, created by a person identified as Satoshi Nakamoto, whose real identity is still not known. A new technology was introduced called blockchain, where once the crypto was created it had to be mined by investors who wanted to own it. There are a fixed number of Bitcoins, which will never be fully mined as the number available will always be a proportion of the balance. Since the concept is one of anonymity, those who own the coin can retain this secrecy. Ironically, the value was denoted in dollars to begin with, which can be traded in other currencies once they are offered for sale on exchanges.

Crypto to be taxed at 30%

After dragging its feet for the past couple of years the Government of India has finally accepted the inevitability of cryptocurrencies entering the mainstream monetary system of the country. Finance Minister Nirmala Sitharaman on February 1 made two major announcements in her budget speech: the Reserve Bank of India will be launching an Indian digital currency sometime this year and income from trading of virtual currency will be taxed at 30% while transfer of digital currency will attract TDS of 1%, which will be paid by the recipient.

This amounts to a much-delayed admission on the part of the government that the cryptocurrency market needs regulation but the pending Cryptocurrency Bill, 2021, is not even listed in the current Budget session. Taxing income from virtual assets might be welcome in certain quarters, but it leaves many critical questions unanswered such as who is going to be the regulator of crypto exchanges, penalties on insider trading, investor protection, required changes in FEMA to buy or sell transborder cryptocurrencies which are traded in dollars, to name a few.

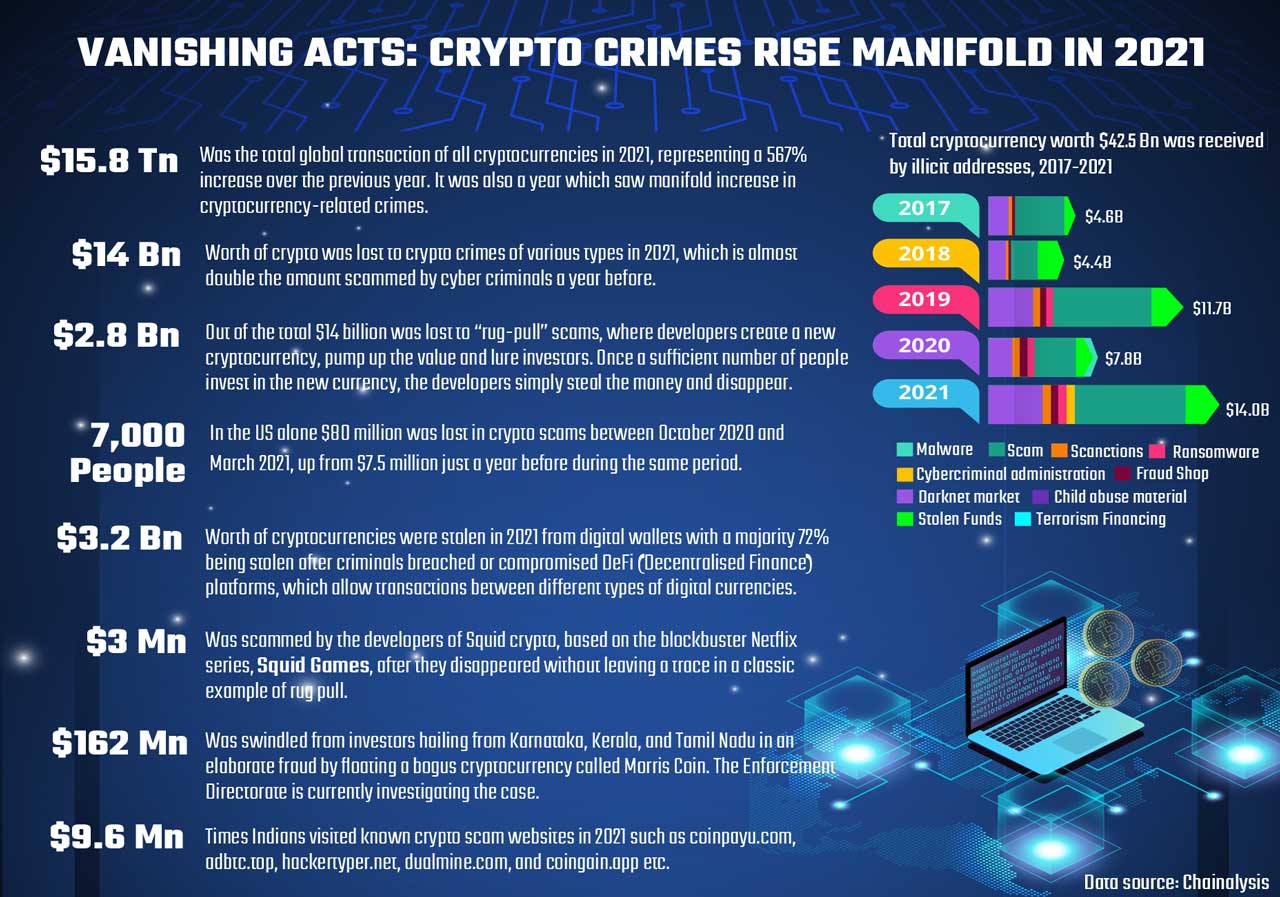

Given that there has been a manifold increase in crypto scams over the past couple of years, merely taxing income from crypto trade without a proper regulatory framework is a testimony of the government’s continued muddled thinking in dealing with the unbridled growth of digital currencies.

–Vivek Mukherji

Bitcoin is the creation of an individual with all those buying or mining it believing in the currency. There is nothing underlying this coin or currency. In the case of gold, the price is related to a physical product. For a share, the company gives part ownership. For currency, one can physically take possession of the dollar, euro or yen. However, for Bitcoin one is buying something which could have been called anything else, like, say, fiction. And trading in Bitcoin is like betting on what time the sun will rise. The question arises: why shouldn’t anyone create their own currency rather than buying Bitcoin?

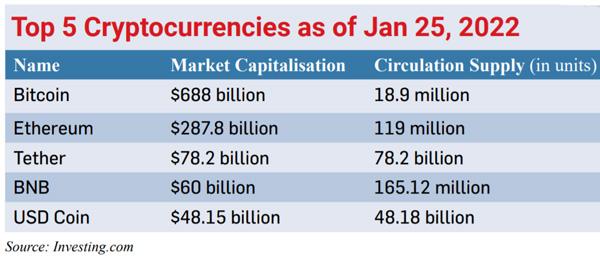

It is not surprising that several cryptocurrencies have come into existence such as Ethereum, Tether, Solana, etc. In fact, over 6,000 came up over time as the logic was that there was no need to take up Bitcoin, rather, one could create one’s own currency using the same technology. Not more than a handful, say, a dozen or two, are actually being traded widely

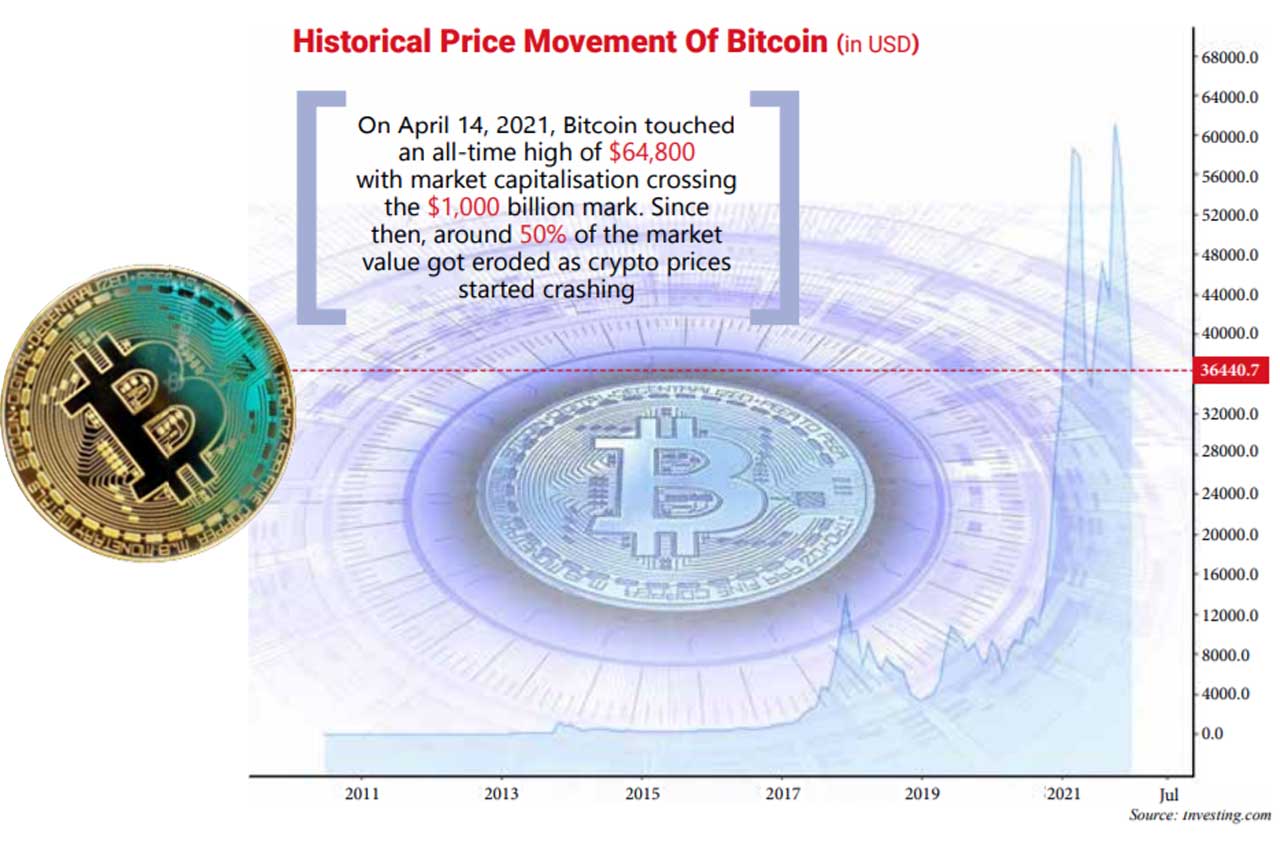

It is not surprising that several cryptocurrencies have come into existence such as Ethereum, Tether, Solana, etc. In fact, over 6,000 came up over time as the logic was that there was no need to take up Bitcoin, rather, one could create one’s own currency using the same technology. Not surprisingly, not more than a handful, say, a dozen or two, are actually being traded widely. Clearly, for any such trade to flourish we need to have several buyers and sellers who believe in the currency. Bitcoin is still the leader and the price went past $50,000 per coin in October 2021.

A Case For Regulation

The crucial issue for the government and regulators is whether these currencies should be permitted or not. The liberal argument proffered today is that the phenomenon has already spread across the world and constitutes the future of financial markets with everyone having a finger or two in the pie. Several countries allow crypto to be used for making payments. The government of El Salvador bought crypto as part of its reserves in the belief that the appreciation, which has been occurring, will enhance its forex reserves’ value. Interestingly, some high-end restaurants in India are willing to accept Bitcoin as payment. Therefore, if everyone is doing it, go with the flow. How far is this argument tenable?

All currencies in the market are used for transactions or as investment. Transactions relates to consumption where the currency is used to buy goods and services. Investment is where one buys anything, hoping the value will go up and gains will be made. We do it for shares or currencies (though this is done by banks and other institutions). It is critical to understand this before going into other regulatory issues.

Regarding being a mode of payment, cryptos cannot and should not be allowed because if they are then the sanctity of central banks will be denuded. In fact, today we are not allowed to use dollars to make payments: it can be a crime. There are also limits on the amount of dollars one can keep at home. This being the case, buying any goods or service with non-rupees is a crime and will come under hawala transactions. This is because of forex regulations.

Corporates can take loans in Bitcoin, buy material using the same currency and sell final goods accepting crypto. Therefore, from a central bank’s perspective, allowing free use of Bitcoin would mean an end to the importance of the institution. This is a good enough reason for making any commercial transaction in crypto illegal and anyone trading in it as a buyer or seller should be prosecuted

Besides, if the medium of currency changes to non-rupees it will create chaos from the policy perspective. Think of a situation where the Reserve Bank of India (RBI) and the Monetary Policy Committee (MPC) are working hard to control the growth in money supply for any targeted purpose. Correspondingly, the economy is running on Bitcoin as people no longer use rupees for payments. In such a case, monetary policy will not matter. Corporates can take loans in Bitcoin, buy material using the same currency and sell final goods accepting crypto. Therefore, from a central bank’s perspective, allowing free use of Bitcoin would mean an end to the importance of the institution. This is a good enough reason for making any commercial transaction in crypto illegal and people indulging in it as a buyer or seller should be prosecuted. There can really be no discussion here.

The issue regarding investment is more open to discussion. Today, one can bet on horse racing as it is a legitimate activity. Since this is so, it should be permitted for trading in fiction. In Western economies, betting in sports is legal and hence logic says that if one can trade in crypto, the currency should be permitted in all activity. Therefore, betting in the Indian Premier League (IPL), which did generate controversy in the past, should be allowed as this would also increase options for speculators. Then there is the issue of what is called ‘dabba trading’, where people speculate on stocks and commodities outside the exchanges. This is illegal in India, but the volumes are large, and it is hard to trace as it is done in an informal setting. One can argue that everything should be allowed for trading and there should be no restriction on any such activity.

Does the Government of India, the RBI and the Securities and Exchange Board of India (SEBI) agree with this argument? If they do, then trading in crypto can be allowed with a customary warning that trading can be dangerous for financial health. All these activities have nothing underlying, which is finally transferred when it is time for settlement. It must be remembered that derivative trading has also been under fire, especially in commodities, but there is a physical underlying entity in the form of shares or commodities.

Legal Gray Zone

The other regulatory issues which need to be analysed in detail are two-fold. The first relates to violations of the Foreign Exchange Management Act (FEMA). Today, the RBI allows one to use forex for specific purposes, but speculation is not allowed. Interestingly, one cannot use dollars permitted under the Liberalised Exchange Rate Management System (LERMS) for derivative trading overseas, though shares and property purchase are allowed. Now, trading in cryptos is quite opaque from the point of view of how the currencies were acquired. If the exchanges merely mirror what is happening in overseas exchanges where there is no ownership of the cryptos, then it would be pure gambling. However, if it is a case of people buying cryptos overseas and then trading in India, it would come under FEMA violation and the RBI would be concerned. Are there clear directives here?

The other issue is taxation. If people are trading in cryptos and making money, are they paying taxes? This is relevant because the present tax laws do not cover gains in cryptos directly. It cannot come under long-term gains because this benefit is permitted when the underlying entity is helping in investment in the country, which is so for debt or equity. But crypto does not provide any boost to investment in the country. Should it be treated as short-term gain? Or is it akin to gains on betting? Laws need to be ahead of the curve, which is not the case here, unfortunately. So far, they have not been covered in the tax book.

Further, since crypto thrives on anonymity, the broader question is do we know who are the owners of the currency we are trading in? This is a problem for the world at large because mafia and terror funding could be making use of crypto for funding. This is something which the traders may never know and they would indirectly become the medium used for funding such activity. This is a global concern, and the government should seriously consider this aspect.

The fact that there is supposedly around ₹7.5 lakh crore invested in cryptos is scary because this means that almost 5% of our bank deposits’ value is residing in these currencies. This amount is equivalent to 60% of what we have in small savings. Therefore, already a major dent in financial savings has been made. Normally, all financial savings can be linked with investment since funds are used for financing growth. But for cryptos it is purely circular trading like in a casino where no value is generated.

Therefore, what are the issues for the government? In a free society, everything should be permitted as long as it doesn’t hurt the public. Hence, trading as investment is okay. But to provide parity across all instruments, gambling should be legalised and taxed probably at a higher rate than any other gain. Every owner should provide a history of how these coins were acquired, because at some stage there would have been a global transaction which should be looked at closely by the RBI. Maybe an amnesty could be announced, asking people to come clean as it could be argued that there were no restrictions in the past.

Finally, anyone using crypto as a medium of payment or acceptance should be booked and the act should be made a criminal offence. Past actions can be condoned since there were no laws prohibiting them. In short, we need to have regulations immediately, and until such a framework is put in place all transactions should be halted as the scale of operations has already ballooned and a roll-back will become arduous.

The writer is the chief economist, Bank of Baroda. The views expressed are personal.