After machli (fish), mutton, Muslim, Prime Minister Narendra Modi, who is seeking a third term, has introduced another ‘M’ — mangalsutra (a gold necklace that is a visual marker of Hindu married women) — in the battle of narratives swirling in the heat and dust of the 2024 general election. Ever since the Congress, which is fighting the fight for its survival, released its manifesto on April 5, for some strange reason, or maybe grand coincidence, Modi’s pitch to get an unprecedented mandate for the ruling BJP has revolved around the word ‘M’.

Speaking at election rallies in Jalore and Banswara in Rajasthan on April 22, Modi said, “They want to snatch the gold of the women and distribute it among the people. When Congress was in power, Manmohan Singh had said the first right over our resources is that of Muslims. They will not spare even your mangalsutra. They will take your money and give it to those who have more children. To the illegal immigrants… They will distribute them to Muslims who they said have the first right to resources. They will go to the extent where they will not spare even your mangalsutra.”

Though the allegation levelled by Modi that Manmohan Singh said that “first right over our resources is that of Muslims” was extensively fact-checked by the media and found to be false, the bizarre reference to mangalsutra, implying that the main opposition party will take away gold jewellery owned by people if it comes to power, deserves closer scrutiny.

According to the World Gold Council, Indian households hold more than 21,000 tonnes of gold in the form of jewellery — the largest private holding in the world. Long before Modi’s wild allegation in Banswara, Indians have been pledging gold to take out short-term loans to meet personal or emergency expenses. This unique financial practice led to the emergence of non-deposit taking Non-Banking Finance Companies (NBFCs) such as Muthoot Finance, Muthoot Fincorp, and Manappuram Finance. These three companies are the biggest players in India’s gold loan market. Of these, Muthoot Finance is the oldest gold loan company that started its operation in 1939.

But it was during the Covid-19 pandemic, when Modi announced one of the harshest lockdowns in the world on March 26, 2020, without any warning, that resulted in largescale job losses, that gold loans shot up exponentially. So much so, that the Reserve Bank of India (RBI) started reporting loans against gold jewellery as a separate line item under the head, Deployment of Gross Bank Credit by Major Sectors, in its monthly bulletins.

In August 2020, the central bank, acknowledging households’ financial crisis, raised the Loan-to-Value (LTV) ratio, including interest amount, from the standard 75% to 90%. “With a view to further mitigate the economic impact of the Covid-19 pandemic on households, entrepreneurs and small businesses, it has been decided to increase the permissible loan to value ratio (LTV) for loans against pledge of gold ornaments and jewellery for non-agricultural purposes from 75 per cent to 90 per cent. This enhanced LTV ratio will be applicable up to March 31, 2021, to enable the borrowers to tide over their temporary liquidity mismatches on account of COVID-19. Accordingly, fresh gold loans sanctioned on and after April 1, 2021, shall attract LTV ratio of 75 per cent,” read the RBI circular.

Three years earlier, in February 2017, in the aftermath of the ill-advised demonetisation that resulted in the scrapping of 86% of high-value currency notes, the RBI raised the limit of gold loan amount from ₹1 lakh to ₹2 lakh, while retaining 75% LVT. Further, in October 2023, the RBI allowed Primary (Urban) Cooperative Banks, which fulfilled Primary Sector Lending (PSL) targets by March 2023, to advance gold loans from ₹2 lakh to ₹4 lakh, under the bullet repayment scheme. Bullet repayment in banking parlance means repayment of the principal and interest at the end of the loan term in one shot.

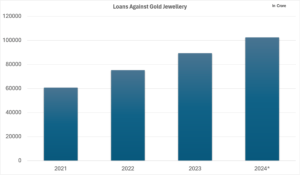

The regulatory easing of lending terms for gold loans resulted in upswing of 68.72% between FY2021 and FY2024, from ₹60,724 crore to ₹102,458 crore (see Figure 1). The increase in gold loans when seen in the context of high unemployment and inflation induced price rise, especially of essential food items, indicates that under Modi’s regime, more households are parting with family jewellery simply to sustain themselves.

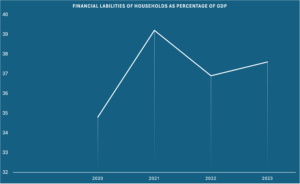

Another data point that busts the government’s spin on the economy is household financial labilities as a proportion of India’s Gross Domestic Product (GDP). According to RBI data, India’s gross household indebtedness, defined as financial liabilities, averaged 37% of GDP between 2020 and 2023 (see Figure 2), touching an all-time high of 39.2% of GDP in 2021. At the same time, net financial savings of households has touched a multi-decade low of 5.1% of GDP in FY 2023 compared to 7.2% of GDP in the previous fiscal.

The exponential increase in gold loans over the past four years under Modi’s primeministership, when seen in conjunction with household indebtedness, points to the crippling impact of acute economic distress on Indian households. Families are pledging gold to tide over this crisis.

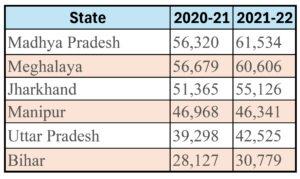

News reports attribute the jump in gold loans, since RBI reporting began, to the significant increase in business in north India of NBFCs. This is significant because large north Indian states — also referred to as cow belt states — such as Bihar, Uttar Pradesh, Jharkhand, and Madhya Pradesh make up the bottom pile of India’s economic pyramid. It’s the poor who feel the maximum impact of unemployment and inflation induced price rise of essential commodities.

Net State Domestic Production (NSDP) at 2011-12 constant prices in ₹ (income)

With more people coming forward to pledge gold as collateral for loans, Scheduled Commercial Banks too have jumped onto the bandwagon. According to a KPMG report, lower middle (earnings between ₹2.5 lakh to ₹5 lakh per annum) and low-income groups (less than ₹2.5 lakh annum) account for 76% of gold loans.

The RBI’s gold loan data, when contextualised with other important data points like rising indebtedness of households, shows that more Indian women were forced to pawn their precious gold jewellery to take loans under Modi’s watch. It’s rich of the Prime Minister to project the inept handling of the economy under his guidance that has led to this economic distress onto the main opposition party. In this age of post-truth, Modi’s claim that the Congress will ‘snatch’ away the sacred mangalsutra is patently false.