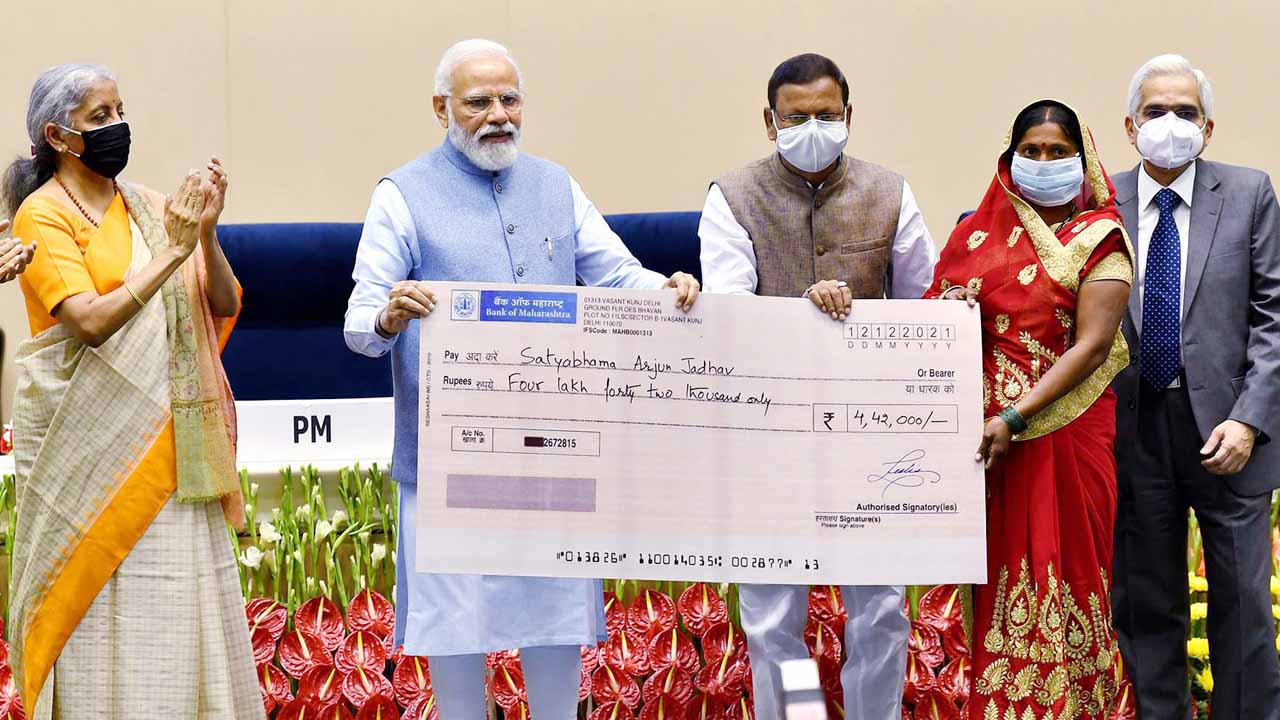

The government has raised the bank deposit insurance cover from Rs.1 lakh to Rs.5 lakh, with the deposited money to be refunded to the depositors within 90 days of the closure of the bank. Speaking at the function, Depositors First: Guaranteed Time-bound Deposit Insurance Payment up to Rs. 5 lakh in New Delhi, Prime Minister Narendra Modi said that the move has already led to more than one lakh depositors receiving their money in the last few days. This amount is more than Rs.1300 crore. The Prime Minister said any country can save the problems from getting worse only by timely resolution of the problems.

The Prime Minister said that measures taken in the last few years have taken the facilities like insurance, bank loans and financial empowerment to a large, underserved segment of the poor, women, street vendors and small farmers. He said banking had not reached women of the country in any significant way earlier, and after being taken as a priority by his government, of the crores of bank accounts opened under Jan Dhan Yojana, more than half belong to women. “The effect these bank accounts have on the economic empowerment of women, we have also seen in the recent National Family Health Survey,” he said.

The first tranche of interim payments has been released by the Deposit Insurance and Credit Guarantee Corporation recently, against claims received from depositors of 16 Urban Cooperative Banks, which are under restrictions by the Reserve Bank of India. With deposit insurance coverage of Rs. 5 lakh per depositor per bank, the number of fully protected accounts at end of the previous financial year constituted 98.1% of the total number of accounts, as against the international benchmark of 80%.