TERROR BY DESIGN – PAKISTAN’s Deep State and Economics of Terrorism: With an economy driven to the wall by a greedy military and inept civil government, Pakistan remains heavily reliant on loans from the IMF, China and Saudi Arabia. While international institutions like the IMF and FATF play a crucial role in promoting financial integrity, their current focus on surface-level compliance may not be sufficient to address the deeper, structural issues that enable financial crimes to persist. A more nuanced and context-sensitive approach is essential to ensure that these standards translate into meaningful and lasting change. Despite several Pakistan-based individuals and groups listed under the UN’s 1267 Sanctions regime, the evidence of state-enabled terror remains strong and undeniable. Experts warn that sustained global vigilance and coordinated pressure are essential to dismantle Pakistan’s long-standing infrastructure of terrorism.

Calculated Gamble to Strike Terror: As IMF team, led by Nathan Porter, during its visit to Islamabad and Karachi from February 24 to March 14, 2025, wrapped up a mission to Pakistan and at the conclusion of the discussions, Mr. Porter issued a statement, “The IMF and the Pakistani authorities made significant progress toward reaching a Staff Level Agreement (SLA) on the first review under the 37-month Extended Arrangement under the Extended Fund Facility (EFF).”

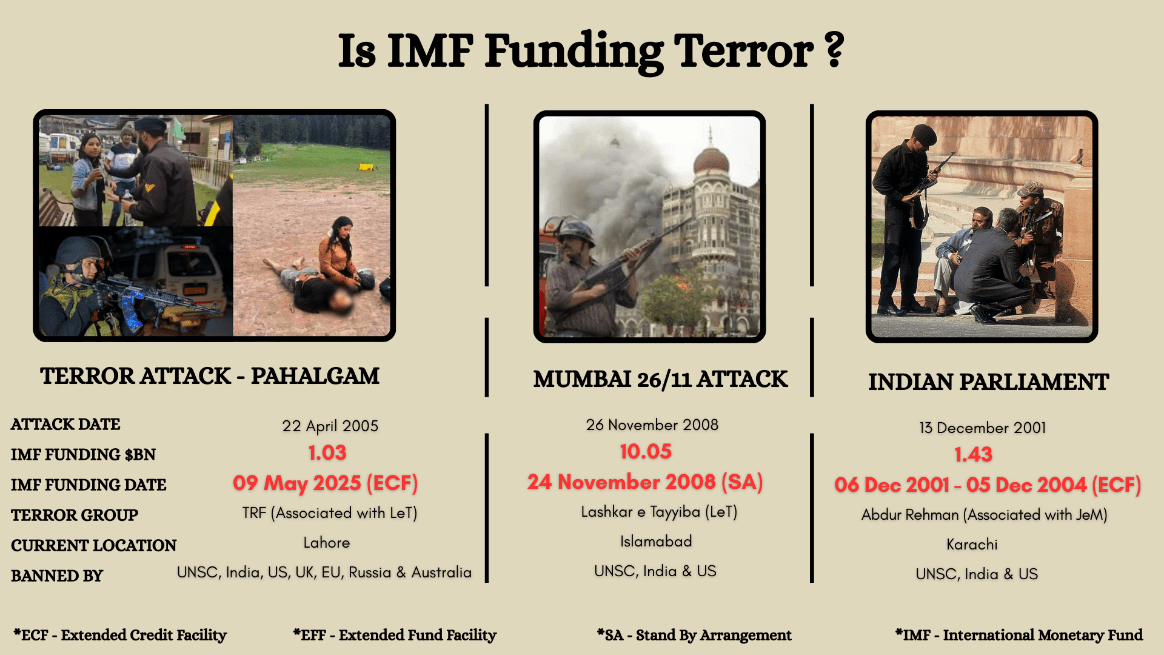

Experts allege that even as the IMF team was in Islamabad, plans were afoot to carry out the April 22, 2025, terror attack in Pahalgam, which killed 26 tourists. The assault, they say, was a calculated move—planned well in advance with local support and reconnaissance—despite the high risk of an Indian military response. Knowingly targeting India meant, Pakistan had the ultimate surety of getting the IMF loan. Citing past retaliations like the 2016 surgical strikes and 2019 Balakot airstrike, analysts argue that Pakistan acted with the confidence of securing IMF funds and counting on U.S. and China backing to manage fallout.

The consequences of IMF funding Pakistan: Decades of IMF support to Pakistan have coincided with stalled structural reforms and unchecked military dominance over the economy, critics say. Despite repeated bailouts, Islamabad has avoided reforming its powerful military establishment, which absorbs a significant share of national resources, leaving little for development and deepening economic distress.

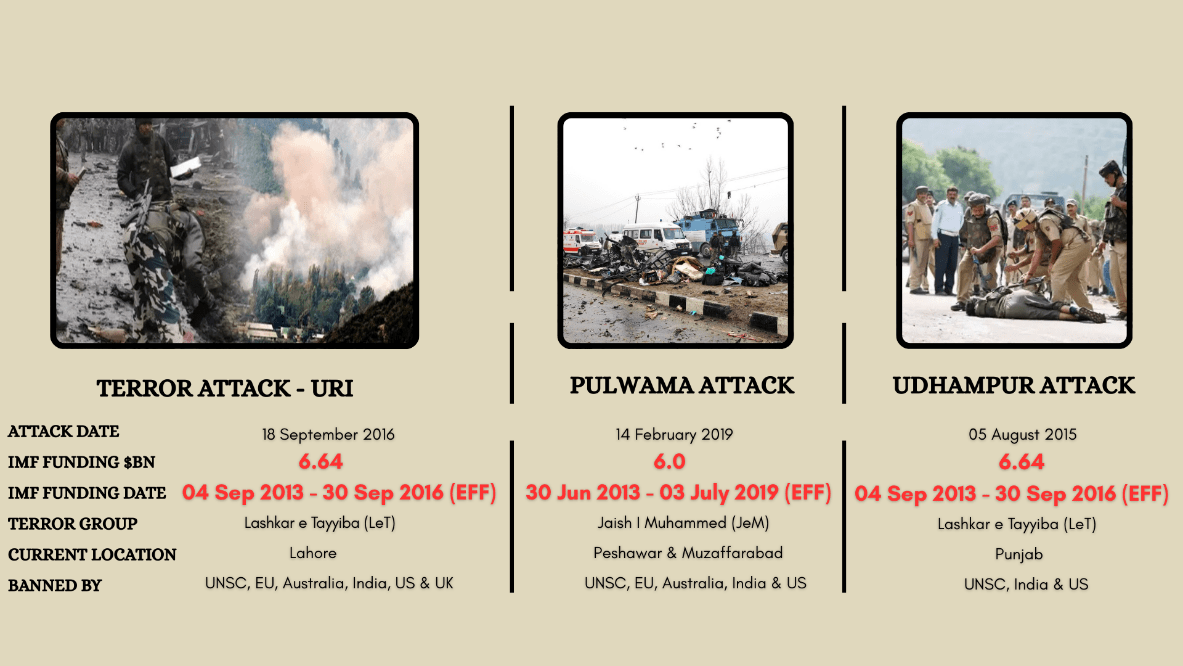

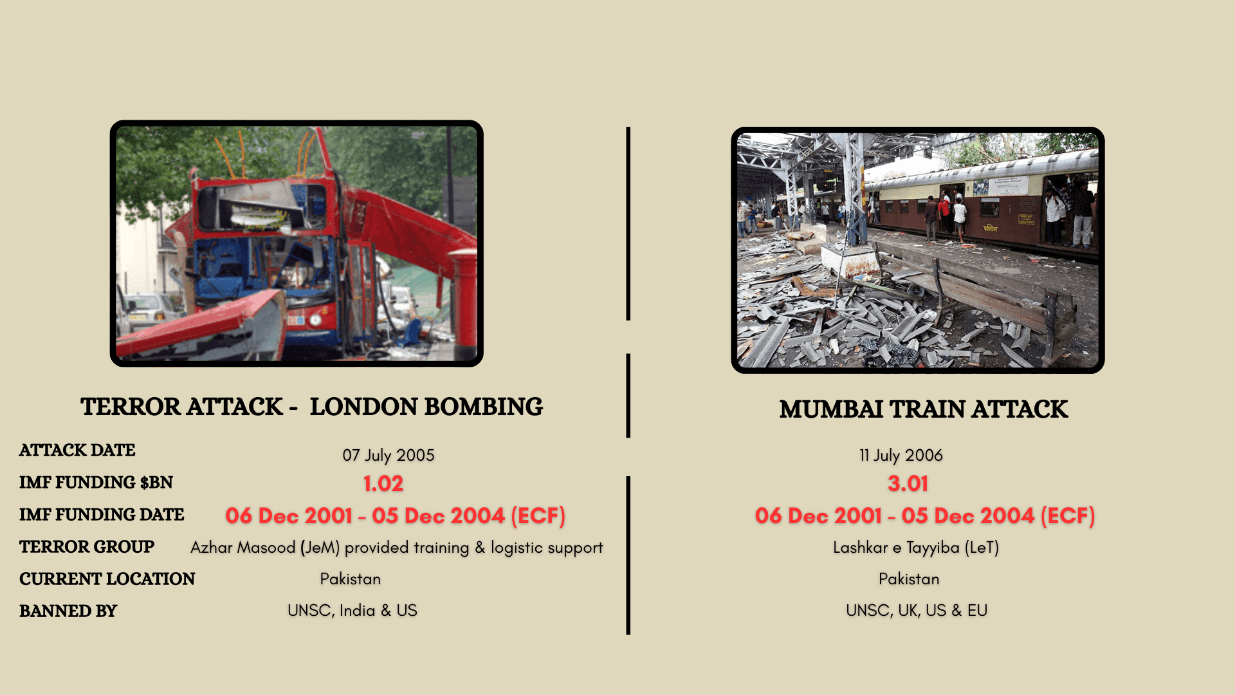

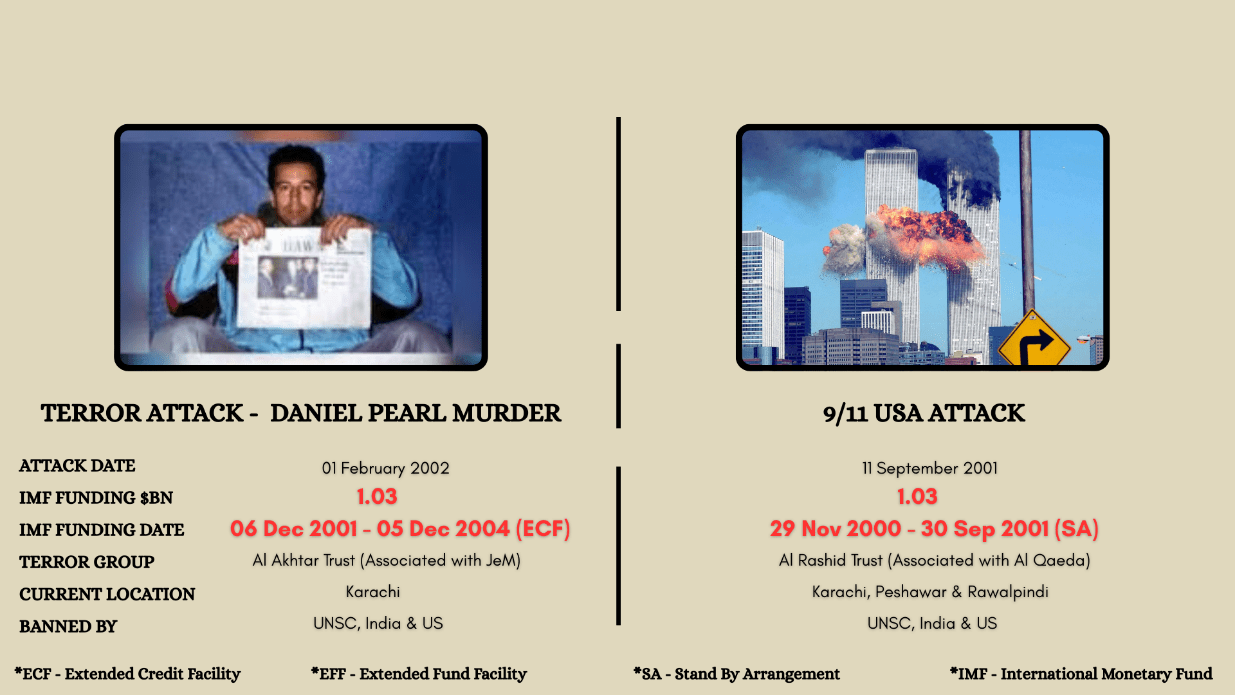

Analysts point to a troubling pattern: major IMF disbursements have occurred around the time of major terror attacks on Indian soil. In 2001, the IMF approved a $1.43 billion Extended Fund Facility days before the Indian Parliament attack. In 2008, a $10 billion bailout came two days before the Mumbai attacks. And within six months of the 2019 Pulwama bombing, Pakistan received a $6 billion IMF package.

Observers argue this “business-as-usual” approach must end. Future IMF disbursements, they say, should include conditions on Defense spending and counterterrorism compliance—similar to benchmarks used by the Financial Action Task Force (FATF). Other key funders, such as Saudi Arabia, are also being urged to tie assistance to Pakistan’s conduct on security and extremism.

India Protests IMF Pay-out to Pakistan, Citing Terror Links and Economic Concerns: India rightly objected to the IMF’s recent $1.023 billion disbursement to Pakistan, calling it ill-timed amid Islamabad’s confession to terror activities across the globe. While the IMF cited progress on inflation, growth, and reforms to justify the fund release—part of a $7 billion Extended Fund Facility launched in September 2024—critics argue the decision overlooks Pakistan’s fragile economy and its continued ties to militant groups. A separate $1.4 billion climate resilience loan was also framed as aid for flood recovery. So far, Pakistan has received $2.1 billion under the program. Indian officials warned the funding risks enabling further violence and terror attacks, even as some analysts suggest Washington may have used the IMF tranche to pressure Islamabad toward de-escalation.

Calls Grow to Tie Pakistan Aid to Defense Cuts, Ending Terror Links: The latest IMF bailout has revived longstanding concerns that international funding to Pakistan lacks critical safeguards. Analysts argue that future aid should be conditioned on reduced Defense spending and a verifiable end to terror sponsorship.

IMF Fund Utilization: The funding’s timing has sparked widespread outrage and raised several eyebrows across the globe. Outrage grew after Islamabad announced compensation of 10 million Pakistani rupees each for those killed in India’s retaliatory Operation Sindoor — including slain Jaish-e-Mohammed (JeM) militants. The strike targeted JeM’s Bahawalpur base, reportedly killing 14 relatives of JeM

chief Masood Azhar, who may now receive over 140 million Pakistani rupees in state funds using taxpayer money. Azhar, an UN-designated terrorist, released in the 1999 IC-814 hijacking, remains on India’s most wanted list for masterminding multiple high-profile attacks, including attacks on Indian parliament (2001), Pathankot (2016), and Pulwama (2019). Further, PM Sharif has reportedly decided to rebuild the Muridke area, where the headquarters of the banned terror outfit LeT was hit by Indian strikes on May 7.

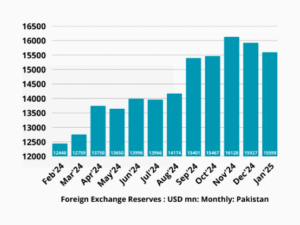

Pakistan’s terrorist actions draw Scrutiny over IMF Funds: The deadly terror attack in Pahalgam, on April 22 has reignited concerns over Pakistan’s role in sponsoring terrorism. Days after the attack came IMF’s – May 9 approval of a $1.023 billion tranche under its Extended Fund Facility, which on May 16 entered Pakistan’s reserves. On May 17, reports revealed that IMF has freshly imposed 11 additional conditions—raising the total to 50—including parliamentary approval of a Rs 17.6 trillion of the FY2026 budget, higher electricity surcharges, and easing curbs on older car imports.

Pakistan’s Growing Debt to China, Saudi Arabia Raises Alarms Over Sustainability: Beijing, Pakistan’s largest bilateral creditor, holds $23 billion of its $130 billion external debt. China’s share has climbed from 7% to 17% over the past decade, underscoring its growing financial influence. Further, like in the case of other nations, Debt rollovers from China have helped Islamabad avoid default and meet IMF benchmarks—crucial for maintaining the ongoing bailout. Pakistan’s heavy reliance on Chinese debt rollovers is raising concerns about its long-term financial stability and credibility with global lenders. This year alone, Islamabad must repay $7.2 billion to Beijing—its largest-ever annual repayment—including principal and interest across multiple loans, according to the World Bank.

Data Source CEICDATA

In March 2025, Pakistan’s foreign reserves dropped to a six-month low of $10.6 billion (equivalent to slightly more than two months of imports), after a $1 billion payment to China. This compelled Pakistan to secure the latest IMF tranche to stay afloat, even as it has asked China to re-profile key loans, delay loans including $16 billion in energy sector debt and an extension of terms of a USD 4 billion cash facility.

Re-profiling would extend repayment deadlines without reducing amounts, offering short-term relief. Meanwhile, Islamabad is under immense pressure to renegotiate costly power contracts with Chinese firms under the China-Pakistan Economic Corridor (CPEC) to lower electricity prices and meet IMF reform demands.

Additionally, in December 2024, came Saudi Arabia’s rollover of a US$ 3 billion deposit with the SBP for another year. The initial agreement was signed in 2021 and rolled over for the next two years. Coincidentally, in April 2023, Saudi Arabia pledged US$ 2 billion to Pakistan, but did not release this till July just before the IMF Board met for its review of Pakistan.

Hafiz Saeed Linked to Kashmir Attack, Renewing Focus on Pakistan’s Terror Ties: Indian officials have linked the April 22 Pahalgam attack to Hafiz Saeed, the UN-designated terrorist and founder of LeT, whose political wing, Pakistan Markaz Muslim League, remains active. LeT, is a designated terrorist group by UNSC, USA, UK, EU, Australia, Russia, and India. Saeed, wanted by India and the U.S. for his role in the 2008 Mumbai attacks, carries a $10 million U.S. bounty and is under international sanctions.

In July 2019, three months before the scheduled reviewal of Pakistan’s action plan by the Financial Action Task Force (FATF), Saeed was arrested by Pakistani authorities. Since, though officially in custody and serving a sentence for 31 years for terror financing, he has been spotted at Lashkar camps in Muridke, Bahawalpur, Rawalkot, and in Pakistan-occupied Jammu and Kashmir — targets of India’s Operation Sindoor. Saeed’s residence continues to be in Johar town in Lahore, where he stays under the constant watch and protection of former SSG commandos. Reportedly, after the Pahalgam attack, he was moved from his Lahore residence to a military cantonment for added security.

His continued presence and mobility in Pakistan, despite global pressure, underscores Pakistan’s alleged state support for terror groups — an issue critics say is routinely overlooked by lending institutions like the IMF, which prioritize financial metrics and procedural compliance over security and accountability.

These organizations receive funding and protection through a mix of state backing and illicit networks, including fake charities, narcotics, and counterfeiting. Despite periodic crackdowns, their survival reflects a broader strategic ecosystem rather than isolated extremism. Even Pakistan’s own Defense Minister, Khawaja Muhammad Asif, recently acknowledged in a TV interview that the country supported terror groups for decades—a “mistake,” he said, for which Pakistan is now paying a steep price.

From Narco to Jihad – The Hidden Arteries of Pakistan’s Terror Machine: Pakistan remains a hub for terrorism, sustained not just by extremist ideology but by a complex, state-nurtured ecosystem. The country’s terror economy is not a single stream—it is an underground river fed by narcotics, extortion, smuggling, and counterfeit currency, with state complicity at every turn. Without a fundamental shift in accountability, that current shows no sign of drying up.

Funding for these groups comes from a shadow economy interwoven with Pakistan’s institutions. A Columbia University study has estimated that 25% of terrorism financing in Jammu and Kashmir came directly from the Pakistani state. The rest flowed through foreign donations, narcotics, counterfeit currency, and criminal enterprises—channels still active today. Charities linked to Lashkar-e-Taiba and Jaish-e-Mohammed continue to collect funds under the guise of humanitarian work, while madrassas serve as recruitment grounds. Lashkar’s Muridke base and Jaish’s Bahawalpur seminary remain prominent nodes in this network.

International Institutions’ Oversight of Compliance – A Surface-Level Approach: Pakistan is home to 83 banned terrorist organizations, with 45 still active and operating, according to the South Asia Terrorism Portal. These groups continue to fuel violence not only in India but across Asia, EU and USA, raising concerns over Islamabad’s role in regional and global security. Pakistan’s Defense Minister himself, recently on TV, admitted to backing militants for decades—a “mistake” with enduring consequences.

International bodies such as the International Monetary Fund (IMF) and the Financial Action Task Force (FATF) have long been at the forefront of global efforts to combat financial crimes, including money laundering and terrorist financing. Their frameworks and evaluations are designed to ensure that nations adhere to international standards, thereby safeguarding the integrity of the global financial system. However, a closer examination reveals that these institutions often focus on technical compliance—assessing whether countries have enacted the necessary laws and regulations—while overlooking the deeper, systemic issues that may persist beneath the surface.

Critics argue that international institutions like the IMF and FATF have too often accepted surface-level compliance while deeper support systems persist. It is this standard approach to international funding that needs to change. Till this happens, Pakistan will continue to use terrorism as an instrument of state policy to further its goals.